F&C 2020: A year in Review

Dien Le

5 years ago · 3 min read

The Year in Review

A Barometer of the Broker Industry

As far back as 2017, Boris Biskupic remarked that Finance and Coffee was a true barometer of the Finance Broker Industry. With over 5200 members logging into the group daily in 2020, it is the place to ask questions, discuss topics that are highly relevant to brokers by brokers at any given time. We quickly know which lender has blown out SLAs, and other industry news such as the monumental announcement of Loan Market buying the NAB owned aggregators.

The Year of the Pandemic

For many, 2020 has been a disaster of a year in terms of social interaction, because let's face it, Humans are social creatures. Whilst there is news of a vaccine, 2021 doesn't look any better and the word “ COVID Normal” is something that unfortunately means that life as we know it will never be the same again. But what the pandemic has done is forced us to use Technology to keep in touch, not only with our friends and family, but also with our clients. Video conferencing and Digital Signatures are two of the most important tools that have come to be used like never before. Banks themselves have been forced to move at pace to implement them. The office environment will also change as larger brokerages (as well as lenders) realise that they can have staff work from home and still maintain efficiencies.

In terms of business, interest rates have never been lower, government (both State and Federal) incentive schemes / grants to aid the property market and add to that, the cash back offers that have been thrown about left right and center, 2020 has been a bumper of a year for Brokers. The numbers do not lie, more loans than ever before were settled by Finance Brokers in Australia. Life as they (Banks) know it, will never be the same again.

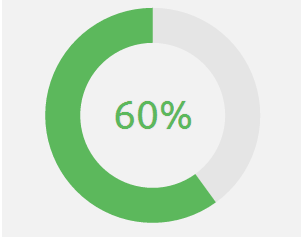

60% Market Share

During the July-September Quarter of 2020, the Broker Channel achieved its highest market share result. 60.1 per cent of all residential home loans in Australia was settled via the broker channel. This was despite the concerted effort by some to undermine the image of the broker to the general public by certain CEOs of banks, “consumer groups”, as well as mainstream media. Massive blowouts in SLAs (blamed on COVID) compounded the headaches that many brokers would have felt. Multiple posts lamenting the fact that lenders should work more closely with brokers because of these results. 2021 will see some lenders do this, however, some will not, and will do what they can to “claw back” that market share that they have lost.

Rise of the Super Aggregators

The biggest surprise (or well kept secret) of the year was the announcement that the Loan Market Group had entered into an agreement