Australians ditch credit cards in favour of alternatives

Alexa Tran

4 years ago · 3 min read

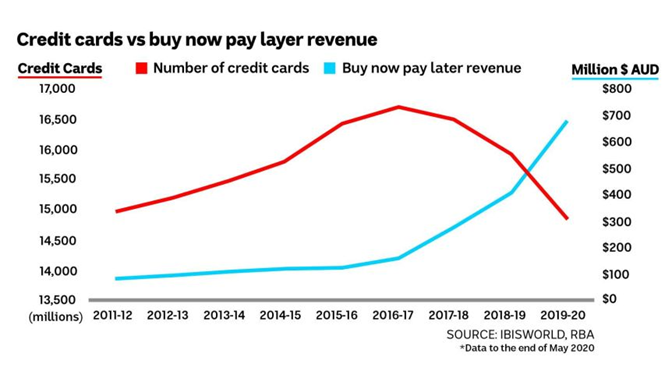

The Covid-19 pandemic has drastically changed the way Australians pay for goods and services. We saw a great number of businesses moving to digital transactions and more people buying things online. More consumers are shunning credit cards in favour of alternatives.

Not too long ago, back in 2006, Australian used credit and debit cards equally. Today it’s a different story. Between March and June 2020, Australians have closed almost 400,000 credit cards, according to RateCity. New data from the Australian Banking Association also show credit card usage has reduced by threefold.

According to the ABA, debit cards have become the most popular mode of payment since the beginning of the pandemic. Debit transactions rose 17 per cent last year compared to the prior corresponding period.

“Debit cards continue to be the number one choice when Australians purchase something in person or online, and that means the majority of us are paying with our savings instead of credit,” Ms Bligh said.

The data shows we’re moving towards a cashless society. Cash transactions which are mostly measured by the volume of ATM withdrawals slumped 10 per cent last year and are still below pre-covid level.

“More and more of us are doing our banking online or through apps and we can expect the use of cash to continue its decline in 2021 and the future.”

Buy Now Pay Later services – a hit with millennials

“We are seeing a generational shift away from traditional credit cards and debt to different forms of payments,” she said.

Credit cards offer big borrowing limits whereas BNPL gives credit on a purchase-by-purchase basis. Buy-now-pay-later platforms like Afterpay and Zip are now promoting themselves as being cheaper for consumers than credit cards and stopping people getting into deep debt.

Younger people are becoming more cautious about using traditional credit cards and consider these online payment-spreading options as safer and more accessible.

Unlike credit cards, their main source of revenue isn’t fees or interest but they’re charging merchants for the privilege to use the platform for a potential to have more sales at checkout time. This is a selling point to most people since there is no hefty interest charge.

For instance, Afterpay makes 85 per cent of its revenue from charging its 55,400 merchants fees. The merchants include some big retailers such as David Jones, Big W and Chemist Warehouse.

Banks have realised the appeal of the interest-free trend and also released interest-free credit cards for a monthly fee to try and compete but again, they mainly charge the card ho