Are brokers ready to put blown out SLAs in the corner and move on?

Alexa Tran

5 years ago · 3 min read

Last year, brokers lived through massive disruptions due to Lender Assessment time blowouts due to the Global Pandemic. Large organisations have Continuity of Business (CoB) Plans in place to handle disruptions, but none even remotely entertained the idea that a large number of their staff would have to work from home. Security of data meant that most large banks didn’t want their staff to “work from home”. Especially the ones with offshore teams.

Loan delays. It happens and it is horrible. It may choke you up thinking about losing clients because of it. We get it. However, nothing shows that we’re ready to put 2020 behind us like a survey about how likely brokers are to continue working with ANZ despite experiencing massive delayed turnaround time last year.

Let’s wind back a bit. Over the past year, the process to secure a loan at major banks have lengthened. In particular, ANZ Bank admitted it took up to 4.5 weeks to approve a loan application due to a simultaneous rush from borrowers to lock in record-low rates with a large share from refinancing requests (taking advantage of the cashback on offer). The percentage of brokers sending applications to ANZ increased from 27% in Feb 2020 to 59% at the end of April. It makes sense that the record number of applications would result in the extra workload, hence longer time for home loans to be approved.

Will brokers still trust ANZ for the long run after it has set them back last year or are they already choosing other banks?

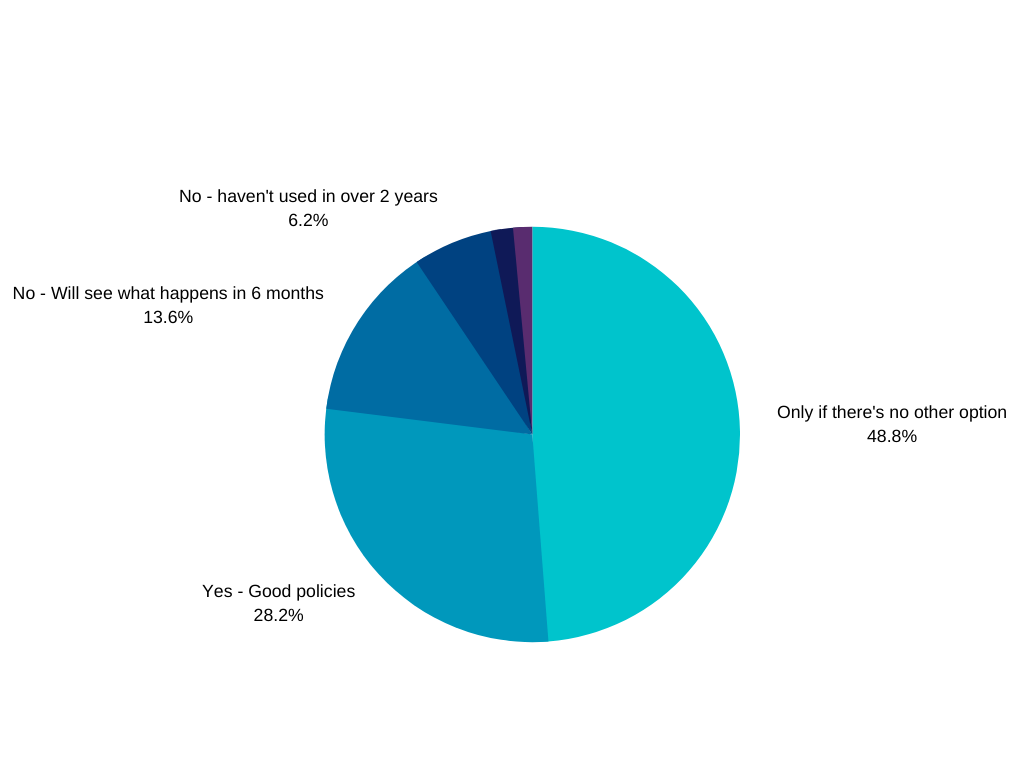

We’re going to be honest: Great policies and cheap rates are still a brokers’ best friends. Yes, some brokers have been burnt and nearly 200 votes in our community said they would continue with ANZ “Only if there’s no other option”. That answer is also followed by more than 114 votes saying “Yes because of good policies”.

For a long time, ANZ had been the bank with the largest broker-originated flow. The majority would still return to ANZ because of great policies such as: LMI waiver at 90% for physiotherapists and other professionals, 1 year financials for small enterprises, 2nd mortgages, parental security guarantee, and of course good BDM Support.

It’s interesting that brokers can list many reasons why they would still go with a bank as long as it’s the best for the situation. What it tells is that Brokers will act in the best interest of their clients. It may surprise some outside the industry... but brokers have done this since day dot! The mainstream media just doesnt like to acknowledge this. Brokers understand they have to find the best deal for their clients regardless of what bank that is offering and what their bank has done to them. The process of acquiring a client is expensive so they will not easily let them just walk away. More brokers prioritise good policies over cheap rates. After all, a finance broker has no commitment to any single institution and is free to work with any lender. Only a broker can compare loans from a bank and other lending institutions – something that a banker cannot.

This year, ANZ is striving to make sure everybody under